Blog

S&P 500 vs. Maailma indeks (VWRL): Kumb on sinu portfellile parem?

Iga alustav ja kogenud investor jõuab varem või hiljem teelahkmele: kas panustada eranditult USA majanduse võimsusele või hajutada riskid üle kogu maailma? See on investeerimismaailma üks suurimaid vaidlusi. Ühes nurgas on S&P 500 – Ameerika Ühendriikide 500...

Maakleri valimine – kuidas valida usaldusväärset maaklerit aastal 2026? Põhjalik juhend investorile

Investeerimismaailmas on viimastel aastatel toimunud tormiline areng. Kui veel kümmekond aastat tagasi oli Eesti investoril valida peamiselt vaid kohalike suurpankade vahel, siis aastal 2026 on pilt hoopis kirjum ja võimalusterohkem. Maakleri valimine on üks...

Kasvuaktsiad vs. Väärtusaktsiad: Kumb strateegia toob 2026. aastal Eesti investorile parema tootluse?

Investeerimismaailmas on kaks igavest rivaali, kelle vaheline vägikaikavedu ei lõppe kunagi: kasvuaktsiad (growth stocks) ja väärtusaktsiad (value stocks). See on nagu valik investeerida järgmisesse Teslasse lootuses, et see muudab maailma, või paigutada raha...

Meelerahufond: Sinu finantsvundament ja esimene samm vabaduseni

Kujuta ette olukorda: on reede õhtu, oled just lõpetanud töönädala ja plaanid nädalavahetust, kui äkki kuuled köögist kahtlast häält. Külmkapp on lakanud töötamast. Või veel hullem – esmaspäeva hommikul ei käivitu auto, millega pead tööle sõitma. Või saabub teade...

Kulla ja hõbeda ostmine Eestis 2026: Füüsiline kuld vs. ETF-id

Kulda investeerimine on läbi aegade olnud üks populaarsemaid viise oma varade kaitsmiseks majandusliku ebakindluse ja inflatsiooni eest. Aastal 2026, mil majanduskeskkond on jätkuvalt muutlik, otsivad paljud Eesti jaeinvestorid turvasadamat just väärismetallidest....

Dividend stocks on the Baltic Exchange: Top 5 stable payers (2026)

Introduction: Why look at the backyard? The year 2026 has ushered in new economic winds, but one basic truth remains unchanged: investors love stable cash flow. But one common theme remains the same: investors love investors. When it comes to passive income, people often look to the US "dividend kings",...

III samba maagia: Kuidas tulumaksutagastus maksimeerida 2026. aastal

Kas teadsid, et Eestis on olemas investeerimisviis, mis pakub sulle igal aastal garanteeritud 28% tootlust veel enne, kui turud üldse liikuma hakkavad? See ei ole krüpto, see ei ole püramiidskeem ega 'rikkaks-kiiresti' pettus. See on Eesti riigi poolt soositud ja...

Defence and defence stocks: how yesterday's taboo became the “new normal” in 2026?

In the investment world, there are few sectors that evoke as much emotion as the defence industry. Until a few years ago, arms manufacturers" shares were considered "sin stocks', lumping them in with tobacco, alcohol and gambling companies. Ethical...

The Baltic Exchange: what and why to buy on Tallinn Stock Exchange in 2026?

When it comes to investing, most people's eyes immediately go to the ocean. There's talk of Nvidia, Tesla, Microsoft and the artificial intelligence revolution. It's only natural - these are the companies that are changing the world and are the ones that get the most coverage in the news. But at the same time...

ETFs vs. individual stocks: which strategy will make you richer in 2026?

There are two major camps in the investment world, which at times resemble religious sects. On the one side are the "passive index investors" who swear that the only right thing to do is to buy the whole market and go to sleep. On the other side are the "active stock pickers" who are looking for the next Amazon...

Investment account system: how to legally defer income tax and grow your portfolio faster?

Have you ever wondered what an investor's biggest expense item is? Most people mistakenly think it's fees, management fees or failed trades. While these are also important, taxes are often the biggest deterrent for the long-term investor. In Estonia...

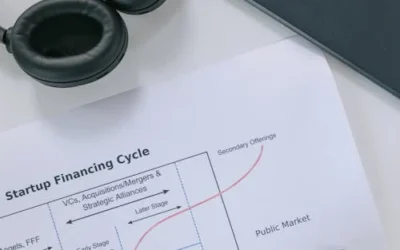

What is an IPO? Comprehensive guide to initial public offerings: processes, pricing and participation strategies

I. Introduction: what is an IPO? An IPO (Initial Public Offering) marks a turning point in the life of any company - the transition from private to public ownership. It's an event that involves both large financial institutions and thousands of...

DeepTech vs. FinTech: 2 big areas, their risks, returns, and what to consider

I. Introduction: the two-fold world of technology The technology sector is widely represented in the investment world, but within it there are two radically different philosophies: FinTech (financial technology) and DeepTech (deep technology). FinTech deals predominantly with...

The most exciting IPO of 2026: what will be the market trends for IPOs in the coming year?

I. Introduction: mature optimism and higher market expectations IPOs (Initial Public Offerings) have always been the hottest topics in the investment community. They offer early entry to potential next big players, but...

Investing in art and collecting: the liquidity trap and partial acquisition

When building an investment portfolio, the focus is usually on equities, bonds and real estate. However, one activity that has long offered protection against inflation and economic crises is investing in art and collectibles. The art world...

AI stocks: 3 investment layers of AI world stocks

Artificial Intelligence (AI) is no longer science fiction. It is an economic reality that is transforming industries from healthcare and finance to manufacturing and transport. AI stocks are the hottest investment theme of the last few years, offering huge potential but also hiding...

Passive income: 7 exciting ways to earn an income

Passive income is the dream, the goal, the holy grail of every investor - money that makes money, with minimum time investment. While most of the debate focuses on dividends from equities and ETFs, there is a whole range of alternative, often higher income...

Euribor and your home loan: 5 strategies to cope with high interest rates

This article is written for educational purposes and provides an overview of financial principles and scenarios. It is not personal financial, legal or investment advice. Before making any financial decisions, always consult a licensed...

Semiconductors (semiconductor) and their shares. What semiconductors are, the 5 biggest players, investing in them and the risks involved.

When it comes to investing, many people immediately think of big consumer brands like Apple or Tesla. But at the heart of every device we use - from smartphones to artificial intelligence (AI) servers to modern cars - beats a modest but indispensable...

Investing in hobbies - arts, sports, films. Case study and 3 main risks.

Can an everyday hobby - whether it's going to an art exhibition, watching a sporting event or hunting for rare collectibles - also be a profitable investment? It's a question that often provokes mixed feelings among investors: should passion be mixed with capital?...

Beginner Investor, Part 3. Investing large amounts of capital: how to diversify risk, optimise taxes and include alternative assets.

If your monthly investment exceeds €1,000, or if you have a large amount of spare capital (e.g. €50,000 or more), you face new challenges and more opportunities. In previous parts of this series, we focused on building discipline and...

Beginner Investor, Part 2. Invest €300 a month: portfolio diversification and tax deferral.

If you're a beginner investor and have successfully mastered the discipline of investing €25-50 a month (as we discussed in our previous article), you've reached the second, more exciting level of the financial journey. Your monthly contribution has grown to €200-500. This is a significant...

Beginner investor, Part 1. How to get started successfully investing small amounts.

Do you feel that investing is only available to those with big wallets? It's a common but dangerous myth that can have a strong impact on the motivation and confidence of the novice investor and keep people away from the financial world. In fact, to get started in investing...

What is Euribor and 3 ways it affects you and the whole European economy

The Euribor (European Interbank Offered Rate) is a key indicator in the financial world that directly affects the daily financial lives of millions of Europeans. It is not just an interest rate between banks, but the basis on which much of the euro area's variable interest rates are...

Quantitative Easing (QE): what it is, how it works and how it affects your investments

Have you been wondering over the past few years why stock prices reached unprecedented peaks or why your mortgage interest rates stayed close to zero for years? Or, conversely, why the fastest inflation in 40 years was so sudden and aggressive? These...

Gamestop craze and meme shares

In January 2021, the financial world was confronted with a phenomenon that shattered traditional expectations of rational market behaviour by demonstrating the power of social media and the collective retail investor. Millions of retail investors, many of them first-time traders, coordinated...

3 reasons why oil prices are one of the most important economic indicators

Oil - the "black gold" - is the artery of the modern global economy. It is the energy that drives cars, ships and planes, fuels industry and heats homes. That's why the price of oil has always been one of the most sensitive indicators of the global economy. History has shown that...

Property flipping. How to ensure success? 4 aspects and risks

Imagine buying an apartment that needs a complete renovation, having it refurbished and then reselling it after just a few months for a significant profit. Sounds simple, right? That's what property flipping is, a financial strategy that has gained popularity in Europe,...

Tesla. The most famous stocks, part 2

When it comes to the stocks that have played with investors' emotions and wallets the most over the past decade, Tesla comes to mind first. It's not just a car company, it's the embodiment of Elon Musk's personal vision that has sought to change the world, move...

Rating agencies and their role and power: how the 3 agencies (Moody's, S&P, Fitch) work, their impact on financial markets and related controversies

Imagine a world where you had to borrow money from someone you didn't know. Before you do, you would want to know his or her solvency and reliability. Is he or she a conscientious taxpayer? Is his income stable? This is exactly the role of the financial world....

Reserve Currency and Cover Currency: 5 facts every investor should know

Have you ever wondered why the US dollar plays such a big role in the world? Why is the dollar constantly talked about as the "king", even if your daily transactions are in euros? It's no coincidence. The global economy and your financial future are influenced by two important,...

Types of income, Part 2. Active income

While in the first article we explored the concept and myths of passive income, we now focus on what is the main source of financial income for most people - active income. This is the income you earn for your time, knowledge and skills. Your salary,...

Types of income, Part 1. Passive income

If you've been around social media or financial blogs in recent years, you've probably come across the term "passive income". The dream of money flowing into your account as if by magic while you enjoy life, travel or just relax is appealing....

NVIDIA's stellar performance. Most famous stocks, Part 1.

Have you been reading the stock news lately and it seems like there's one name on every corner - NVIDIA? It's no coincidence. It's a company that has risen from the ashes in recent years to become one of the world's most valuable and talked about companies. But what is...

Financial market trends, Part 3. The crab market: how to make money when the market is stagnant

After the tumultuous fall in the bear market and the energetic rise in the bottle market, the market may remain unexpectedly quiet. It is like being at sea, where the waves have subsided and the water is flat. While it may seem dull at first glance, it is in fact a challenging period known as the...

Financial market trends, Part 2. The bull market: how to invest wisely in a bull market

After turbulent bear market periods of fear and uncertainty, financial markets often experience a new breath of fresh air - a bull market. It is like the sun rising after a long, dark storm, with new hope and growing optimism on the horizon. If the bear market could be compared to...

Financial market trends, Part 1. Bear market: how to find opportunities in falling markets

Every investor feels that sense of anxiety when markets start to fall. It's like stepping into a deep, cloud-covered valley - the visibility is poor, the path seems unpredictable and the fear can worsen with every step. Pessimism is rife in the media, the news is full of threatening...

How fundamental analysis can help you select valuable companies. 3 reports to follow.

In our previous article, we looked at technical analysis - a method that focuses on price movements on charts. It's like a driver's speedometer: it gives you information about speed and direction, but says nothing about the state of the engine. The other main method of analysis,...

Technical analysis: how can you predict stock prices using charts? 3 basic indicators

Investing and the financial world are often full of emotion and uncertainty. But how do you make rational decisions based on facts, not emotions? Investors have several main approaches to market analysis. One of them, fundamental analysis, focuses on...

Portfolio optimisation: 4 strategies to achieve the best balance between risk and return

In the investment world, one of the main objectives is to achieve maximum return with minimum risk. However, this is no easy task, as risk and return are closely linked. The rule of thumb is that the higher the potential return, the higher the...

Financial crises - 6 recent crises and their lessons learned

Financial crises - these words can cause anxiety and conjure up images of panicked stockbrokers or bankrupt companies. While some historical storms, such as the Tulip Mania of the 17th century or the Great Depression of the 1930s, are lessons in their own right, it is...

3 world-famous investors every investor should know

The world of investing is full of fascinating stories and colourful characters who have left a profound mark on the global economy through their strategies and decisions. Behind these success stories, however, lie not just numbers and graphs, but also human experiences, lessons and wisdom,...

Comparing European pension systems: how to plan your retirement wisely?

Ageing is an inevitable part of life, but growing old with peace of mind and dignity requires conscious planning, especially when it comes to financial security. Retirement may seem like a distant dream beyond the mountains to a young person, but the truth is that the foundation for the future...

Trade wars and tariffs: how they affect investment decisions

Have you noticed in the news lately how there is more and more talk about trade restrictions, sudden price rises or international economic tensions? Perhaps you've even wondered what all these terms and political...

Investing and improving your investment plan: 6 steps to success

Have you already taken your first steps in the world of investing and set up an investment plan? That's great! But investing is a dynamic process, and your plan needs constant care and attention to keep it in line with your goals and the market situation....

Put together your investment plan: 6 things to know as a beginner

Have you ever wondered how to achieve your financial goals - whether it's a comfortable retirement, buying your dream home or exploring the world? Investing is one of the key tools that can help you grow your money and make your dreams a reality....

Is volatility your friend or foe? 5 suggestions to make the most of it

"The stock market is a device for transferring money from the impatient to the impatient" - Warren Buffett In the world of investing, the word "volatility" is often used to describe fluctuations in the price of an asset. Some investors fear volatility like wildfire, while others see it as an opportunity. But...

The messy world of stockbrokers: "The Wolf of Wall Street and its 5 lessons

Martin Scorsese's 2013 film "The Wolf of Wall Street" offered a shocking and entertaining glimpse into the glamorous yet highly immoral world of young stockbrokers. Leonardo DiCaprio plays Jordan Belfort, who, along with his fellow...

Rational investing: how to tame emotions and get rid of prejudices? 8 recommendations

Imagine the following situation: you have invested in shares and the market is down. The news is full of negative forecasts and everyone around you is panicking. Either you sell your shares to avoid further losses, or you keep calm and stick to your investment plan....

Insider dealing: breaking the information monopoly in the stock market

In 2011, the US financial world was rocked by scandal when Raj Rajaratnam, founder of the Galleon Group, was convicted of 14 insider trading offences. Rajaratnam, once one of Wall Street's most influential investors, illegally made millions of dollars using...

Diversification of investments: the road to a more secure future

"Investing is like gardening. You don't plant all the seeds in one place." In today's fast-changing economic environment, with inflation eating into savings and geopolitical tensions creating uncertainty, strategic management of an investment portfolio is more important than...

Saving vs investing: which is right for you?

There are two main strategies for planning your finances: saving and investing. Both are important for achieving financial security, but there are important differences between them. In this article, we explain the differences between saving and investing and help you...

Day trading and 5 other strategies - what should you know?

nInvesting is a journey towards financial freedom, but it can take many different paths. Some investors prefer to take the highway, taking risks and looking for quick returns. Others, however, choose a more leisurely pace, investing for the long term and...

IPO risks: what should you know before investing? 3 examples.

An IPO (Initial Public Offering) is a big step for many companies. It is a way to raise significant capital, raise awareness and provide liquidity for early investors. For investors, too, an IPO can be an attractive opportunity....

Economic cycles and their impact on your investments

The economy is like a living organism - it breathes, grows, slows down and recovers. These ups and downs we call business cycles are an inevitable part of how the economy works. And while we can't fully control these cycles, we can understand them and...

Investing in a downturn: opportunities and threats

"Be greedy when others are afraid, and fear when others are greedy." This famous quote from Warren Buffett captures the essence of investing in a recession. While the recession creates uncertainty and fear, it also offers unique opportunities for investors who...

Sustainable investing: how to grow your money responsibly

In today's world, we face a number of global challenges, such as climate change, inequality and resource depletion. More and more people want to invest their money in a way that takes into account not only financial performance, but also the environment, social...

Investing and politics: what should every investor know?

Investing is a journey towards financial security, but it is not an isolated journey. Global events, economic trends and political decisions all have an impact on markets and therefore on your investments. While politics may seem distant and...

S&P 500: a barometer of the US economy and a global influencer

Did you know that the S&P 500 index covers about 80% of the US stock market value? It's one of the world's most closely watched stock indices and gives investors a good insight into the health of the US economy. In this article, we'll take a closer look at what the S&P500 is, why it's important and...

Financial automation: how to save time and money with smart tools

Tidying up your finances can sometimes feel like a chore. E-bills pile up in your inbox, savings plans are forgotten and you only hear about investment opportunities when the train has already left the station. Sound familiar? Luckily, there are solutions that let you forget....

Investment psychology: how to keep your head cool and make rational decisions

Investing can be like a thrilling ride on the American mountain - one minute you're euphoric at the top of the sky, the next minute you feel your stomach ache from the sudden drop. Fluctuating emotions are an integral part of investing, and coping with them can be just as...

Investment platforms: a guide for the beginner and advanced investor

Investing has become an increasingly popular topic today. We all want to grow our money and secure a better future for ourselves and our families. Fortunately, today's technology has made investing more accessible than ever. At the heart of it is...

Pension funds and their far-reaching impact on the Estonian economy

Estonia's pension funds are not just places where a small part of our paychecks quietly disappears each month. They are giants of the financial markets, whose decisions affect our future pensions and the future of the Estonian economy. They are like invisible forces that...

Shorting - an investment strategy for the bold

Most investment strategies are about buying cheap and selling dear. This is the name of the game in investing. But what if there's an opportunity to profit from the opposite - a fall in asset prices? That's what shorting is. In this article...

Investment fraud and schemes

Investment fraud and schemes are unfortunately a widespread problem that threatens everyone's financial security. They are designed to defraud investors out of money by offering them false information or false promises of high returns. Investment fraud is a deliberate deception,...

NFT-glut: What was it, why did it explode and is it gone?

What is NFT? NFT, or Non-Fungible Token, is a token that cannot be installed. It is a digital asset whose main characteristics are uniqueness and irreplaceability. Unlike conventional cryptocurrencies, which are interchangeable (such as Bitcoin), each NFT is a...

Dollar Cost Averaging: investing without forecasting

Have you ever seen a bag of potatoes for sale in a shop? Sometimes the price is higher, sometimes lower. Do you always wait for the absolute lowest price to buy potatoes, or do you prefer to buy smaller quantities at a lower price on a regular basis? The same logic can be...

Real estate investment: advantages and disadvantages

The fascinating world of property investment Have you ever thought about putting your money to work in a long-term, stable job? Real estate investment offers just such an opportunity. It's a time-tested way to grow wealth and passive income....

Bitcoin Halving - Excitement and Opportunities for Investors

If you've heard of Bitcoin and how it works, chances are you've heard of a related event that happens every four years - the halving of Bitcoin. While the term may be familiar, the content and implications of the...

Crypto threats

The dangers of crypto: glitter and fraud Cryptocurrencies have attracted investor attention over the past decade with promises of huge gains in a decentralised financial system. Stories of people who have become so-called crypto millionaires by investing minimal sums are...

Investing in luxury goods

Have you ever thought of your favourite handbag or watch as more than just a fashion accessory? In recent years, investing in luxury goods has become popular, offering investors a potentially lucrative way to grow their money. Luxury goods...

How robo-advisors can help you

Money plays an important role in our lives. Saving and making wise investment decisions can help us achieve financial security for the future. However, it is important to consider a number of factors when making investment decisions, from risk tolerance to market conditions. It can...

Alternative investment opportunities

Saving and investing money are important steps in securing your financial future. Investing in stocks and bonds is a traditional way to grow wealth. But diversifying your investment strategy is a good way to reduce risk....

Defining investment objectives and timeframe

Investing starts with setting goals Investing is an exciting journey that can lead you to financial freedom and a secure future. It's an exciting journey, but before you take the first step, there's one important element missing - the destination. Where do you actually...

Cash during inflation

Rethinking investment strategies in times of inflation Recent high inflation has rattled investors, forcing them to reassess traditional investment strategies. Cash, once seen as a safe store of value, is losing its real...

Case study- Redditi IPO

Introduction Have you heard of Reddit, the internet's "front page"? This birthplace of memes and news feeds, where millions of users gather in communities around different topics, made waves in the investment world in March 2024. Reddit's IPO was...

Investment strategies for different life stages

Investment life stages: adapt your investment strategy to your life stage Life is an exciting journey that takes us through different stages. When we are young, we enjoy freedom and dream big. In middle age, we take responsibility for our families and careers. In the golden years...

Building a diversified investment portfolio

Investing: sailing in unknown waters Investing is like sailing in unknown waters. To succeed, you need to consider two important factors: risk and reward. This article dives into the fascinating world of investing, explaining the concept of risk and return....

Investing: growing assets for the future

Introduction Investing is an important concept in the world of finance, allowing you to grow your money and build long-term wealth. It is a process where people buy assets, such as shares, property, and many other different financial instruments, with the aim of earning...