IPO risks: what should you know before investing? 3 examples.

An IPO (Initial Public Offering) is a big step for many companies. It is a way to raise significant capital, raise awareness and provide liquidity for early investors. For investors, too, an IPO can be an attractive way to share in the growth of new and promising companies and earn high returns.

But like any investment, IPOs come with risks. Sometimes things don't go according to plan, and an IPO can turn into a nightmare for the company and its investors. In this article, we take a look at what the risks of an IPO are, and explore the most common risks and problems that companies and investors can face.

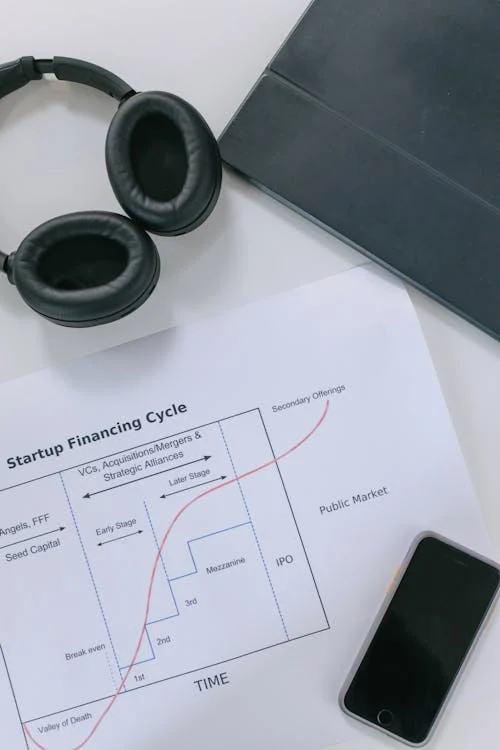

But let's start at the beginning and briefly explain what an IPO is and why companies go public in the first place.

IPO process: a brief overview

Before we dive into the perils of IPOs, let's take a quick look at the IPO process itself. While it may seem simple - a company sells its shares to the public and gets money in return - the reality is much more complex.

The IPO process involves a number of steps that require careful planning and execution:

- Preparation: The company needs to organise its financial statements, create a business plan and make other necessary preparations to be ready to become a public company.

- Involvement of bank brokers: The company usually hires underwriters to help organise the IPO process, including setting the share price, marketing the IPO to investors and securing the sale of shares.

- Preparation of the prospectus: The company prepares a prospectus containing detailed information about the company, including its financial position, business model, risks and future plans. The prospectus is an important document to help investors make informed investment decisions.

- Roadshow: The company's management and bank brokers organise roadshows where they meet potential investors and introduce them to the company and the IPO.

- Determining the share price: Bank brokers help a company set the price of its initial public offering (IPO) based on investor demand and the value of the company.

- Stock exchange listings: Once all the previous steps have been successfully completed, the company's shares are listed on the stock exchange and investors can buy and sell them.

While the IPO process may seem simple, it is actually complex and time-consuming. It requires significant resources from the company and comes with a number of risks.

The magic of IPOs: why are they so attractive?

IPOd offer a range of potential benefits for companies and investors alike, often making them very attractive.

For businesses

- Raising capital: An IPO is one of the main ways for companies to raise a large amount of capital that can be used to expand their business, develop new products or services, repay debts or for other strategic purposes.

- Increasing awareness: Going public raises a company's profile and credibility with the public. It can help attract new customers, partners and employees.

- Attracting talent: Stock options in a public company can be an attractive bonus for talented employees, helping the company to attract and retain the best talent.

- Liquidity for early investors: An IPO offers liquidity, or the opportunity to sell your shares and withdraw cash, to early investors in the company, such as venture capital funds and angel investors.

For investors

- High return potential: IPOs are associated with the hope of earning high returns, especially if the company is successful and its share price rises significantly after the IPO.

- Access to new and exciting businesses: IPOs offer investors the chance to invest in new and innovative companies with the potential to change the world.

- Portfolio diversification: Investing in IPOs can help investors disperse your portfolio and reduce risks.

These potential benefits make IPOs an attractive option for companies and investors alike. However, as we will see in the next section, IPOs are not always a success story, and they come with significant risks.

IPO risks: when things go wrong

While IPOs may look promising, they are not always a success story. In reality, the IPO process can be complex and risky, and many companies and investors have been disappointed.

IPO failure

Not every IPO is successful. Sometimes companies simply fail to attract enough investor interest or market conditions are unfavourable. For example, many IPOs around the world were cancelled or postponed in 2022 as investors became more cautious due to the economic downturn and geopolitical tensions.

Even if a company makes it to the stock market, it may not be a success. Many companies have seen their share prices plummet after an IPO, leading to huge losses for investors. For example, in 2021, the UK food delivery platform Deliveroo the highly anticipated IPO, but its share price fell by nearly 30% the day after the IPO.

Fraud and misconduct

Unfortunately, the world of IPOs is not immune fraud and misconduct. In the IPO process, some companies may present exaggerated financial forecasts or hide important risks to attract investors. There may also be a risk of insider dealing or other illegal activities.

One of the best known examples of fraud is a US company. Theranos, which claimed to have developed revolutionary blood analysis technology. Although the company did not make it to an IPO, they had raised over $700 million from investors. However, the company's technology then proved not to work and the company collapsed, leaving investors with huge losses.

These examples highlight the downside of IPOs and emphasise the need for investors to be cautious and do thorough research before investing in IPOs.

Difficulties after the IPO

Going public also brings with it a number of new challenges for businesses. As a public company, they have to comply with strict reporting requirements and regularly publish their financial data. This can be time-consuming and costly. In addition, there is increasing pressure on public companies to show good results to keep investor confidence and share prices high.

After an IPO, some companies may focus too much on short-term goals, such as improving quarterly results, instead of focusing on long-term growth and innovation. This can damage a company's long-term competitiveness.

Failed IPOs and disappointments

While there are many success stories in the IPO world, it is not risk-free. Let's take a look at some well-known examples where things didn't quite go according to plan.

WeWork: overpriced dreams

WeWork, a provider of shared offices, was one of the most anticipated IPOs in 2019. The company was valued at $47 billion and its founder Adam Neumann was known for his charismatic management style and ambitious plans. However, the publication of the IPO prospectus highlighted a number of worrying aspects, including the company's large losses, unclear business model and Neumann's controversial management style. Investors became wary and WeWork was forced to postpone the IPO and revise its valuation downwards significantly. In the end, the company went public in 2021 via SPAC (Special Purpose Acquisition Company) at a much lower valuation.

Uber and Lyft: a question of profitability

Transport companies Uber and Lyft made their IPO in 2019 with great fanfare. Investors were excited about the disruptive business model and growth potential of these companies. But after the IPOs, share prices of both companies plummeted as investors became concerned about their profitability and sustainability. Both companies had been generating heavy losses for years and their path to profitability was unclear. Although both companies' shares have since recovered somewhat, their long-term success remains unclear.

Facebook: initial disappointment and later success

Even some of today's biggest tech giants have experienced post-IPO difficulties. Facebook IPO 2012 was initially a disappointing year as the share price fell in the first days after the IPO. Investors were worried about the company's ability to generate earnings. However, Facebook proved the sceptics wrong and its share price has since risen several-fold, making it one of the world's most valuable companies.

These examples show that investing in IPOs is not risk-free. Even the most promising companies can experience difficulties after an IPO and investors need to be prepared for potential setbacks. This further underlines the importance of thorough research and understanding of the risks of an IPO and the risks associated with the investment before making decisions.

The importance of due diligence and investor protection

The downside of IPOs clearly demonstrates that investors need to be careful and do their due diligence before investing in IPOs.

due diligence or due diligence, means that an investor should gather and analyse all available information about a company and its IPO in order to make an informed investment decision. This includes analysing the company's financial statements, business plan, management and competitors, and assessing risks.

Investor protection is also an important aspect of the IPO process. Regulatory authorities, such as the Estonian Financial Supervision Authority, play an important role in ensuring that IPOs are transparent and investors' interests are protected. They scrutinise companies' prospectuses, monitor the IPO process and take action against fraud and misconduct.

The awareness and education of investors themselves is also very important. Investors should understand the risks of IPOs and be prepared to do their own research. It is also advisable to consult a financial adviser before making an investment decision.

To sum up

IPOs can be a great opportunity for companies and investors, but they also come with IPO risks. IPO failure, post-IPO difficulties, fraud and misconduct are just some examples of the problems companies and investors can face.

It is therefore important for investors to be cautious and do their due diligence before investing in IPOs. Due diligence, regulatory oversight and investor education are all important factors in ensuring the integrity and transparency of the IPO market and protecting investors from potential losses.

Investing in IPOs can be exciting and potentially lucrative, but it also requires awareness and caution. Don't be dazzled by the glitz and glamour of IPOs, but always carefully consider the risks and opportunities before making an investment decision.